The great GPU crisis - why are graphics cards so expensive now, and just how bad is it?

None shall escape the crypto goldrush

If you've made a point of leaving any conversation as soon as you hear the sound 'bitc...' start to emanate from someone's face-hole, I've got some bad news for you. The effects of the cryptocurrency goldrush are no longer confined to twitchy-eyed evangelists and screechy news headlines - for the second time in recent memory, it's caused a huge spike in graphics card prices, both new and second-hand, as the crypto-clan rush to snaffle up any GPU they could possibly use to mine blockchain currencies such as Ethereum and Zcash. Even the recent decline in crypto exchange rates hasn't brought GPU pricing back down to Earth - quite the opposite, in fact.

This means two things for us, in practice. 1) Now is the worst possible time to buy a new graphics card for gaming 2) now is the best possible time to sell on any unused old graphics cards you own.

One thing I'm not going to do here is get into any speculation or armchair theorising about the future and/or wisdom of cryptocurrencies, beyond observing that their rise, fall or constantly spiking variations thereof is likely to affect graphics card prices until either something significant happens either in the entire crypto industry or hardware-makers take a concerted stand. I want to stick to what this means for us, as players of PC games in early 2018.

Let's take the case, for instance, of the Nvidia GeForce GTX 1070, a card that for the last year was one of the best graphics cards for people who want to play new PC games at near-maximum settings at 1080p or QHD without breaking the bank. Even as recently as mid-December, you could pick up a GTX 1070 for as low as £350.

Today? Well, for starters you almost certainly won't be able to find one direct from a retailer, be that high street or the likes of Amazon. They've all been bought up and either dedicated to mining or scalped onwards. The ones you can find are by and large restricted to resellers on Ebay and Amazon, with prices massively hiked to reflect the demand. As such, the cheapest in-stock and new GTX 1070 I can find on Amazon UK is £560, and from a third-party reseller. Over £200 more than it would have cost just a few weeks ago - and more than a mighty Nvidia GeForce GTX 1080 would have cost at a similar time. Amazon does list a 1070 for £511, but, as with most any mid or high-end current GPU right now, it's back-ordered.

Some retailers are directly selling GTX 1070s, such as Scan - but unhappily they're priced at £550 minimum, and almost all are out of stock and on back-order. That's the bonkers situation in a nutshell.

This price-perversion spreads like a stain in both directions. An Nvidia GeForce GTX 1060 (more useful 6GB model) now goes for close to what a GTX 1070 'should' cost, for instance, the cheapest new one coming in at £334 at the time of writing - but again that's on back order, with the cheapest in-stock being £340. By contrast, as recently as the closing days of December 2017, you could snag one for £215. That's around a 50% bump in the space of little more than a month.

However, prices for the more powerful GTX 1080 and GeForce GTX 1080 Ti aren't quite as heavily affected in many places, as their heavier power consumption broadly makes them less proportionally efficient for mining, due to energy costs and PSU needs. Perversely, right now it's even possible to buy a GTX 1080 for £487, significantly less than a GTX 1070, although the ongoing stock shortages mean you'll likely be in a for a long wait. At the same time, we are seeing hundreds of pounds/dollars being added to the prices of in-stock 1080s and 1080 Tis, with the latter occasionally selling for four figures to miners in a hurry.

Even older generation cards are affected. There are new GTX 980s selling for £422, whereas this time last year the Amazon Warehouse had refurbished 980s going for just £200. A second-hand GTX 970, meanwhile, can go for as much as £250, whereas a few months ago a seller'd be lucky to get £80.

What this means, unhappily, is that people with cash to flash aren't too locked out by the blockchain goldrush, but those of us whose means limit us to mid-range cards - the £200-300 bracket - are going to have a very hard time until either the crypto bubble bursts in a more permanent way than the current decline (which itself is luring many speculators buying or mining low to potentially sell high later), or governmental regulation or hardware company restrictions break up the party.

All this affects AMD just as much, by the way, with the AMD Radeon RX 570 and AMD Radeon RX 580 being much sough-after for mining right now.

However, it's even worse for the newer RX Vega 56 and RX Vega 64 cards, which are almost impossible to find new and in-stock because they're so well-suited to digging for Ethereum, the world's second-largest crytocurrency, after Bitcoin. Techspot recently reported that it was unable to find a single Vega 56/64 in stock in the US or Australia.

Even older cards on the second hand market are also suffering/benefiting from the craze. Let me give you an example of my own. For the past year, I've had a Radeon R9 Nano - a mid-range card at best by today's metrics - sat unused in a drawer, as I'd upgraded to a GTX 1080 Ti to power my stupid ultra-wide monitor last year.

This card was released in summer 2015, and originally RRPed at $650/£450. In 2016, it received an official price cut, down to $499/£350. As recently as December, i.e. mere weeks ago, I would have been lucky to get £250 for it on eBay.

A couple of weeks ago, in the name of experimentation and not for one minute expecting it to work, I listed it for £380. I figured that ultimately I'd lower that to around £300 and be very pleased with that indeed.

When I woke up the following morning, it had sold. £380. Guess who's getting himself a new mobile phone this year? But also: holy shit, this is so messed up. Right now there are no R9 Nanos listed on eBay, leading me suspect that I could have gotten even more had I waited a few weeks.

The primary reason for all this is, as I say, crypto-mining, a craze so pervasive that even UNICEF are getting into it. However, a current worldwide shortage of fast RAM for graphics cards and systems alike is further compounding the problem. DDR4 sticks are also boasting inflated prices right now, and also with no apparent end in sight. It's not anything like as hard to come by as GPUs are, but the prices are even further through the roof - the cheapest 8GB DDR4 stick I can find is £63, whereas less than a year ago you could bag similar (but faster!) for £40. Even the older DDR3 is not spared, and nor is the GDDR5 used by most well-specced new graphics cards.

Though the amount of cash you have to lay down to buy system RAM is still much smaller than that required for a decent new GPU, memory costs have overall risen more dramatically and it's not looking like that will change any time soon. There is no one absolute reason for the DRAM price-hike, but the two most prevalent theories are that mobile devices and servers are occupying too much of the supply chain (although mobile growth seems to be slowing), and allegations of collusion on the part of primary DRAM manufacturers Micron, SK Hynix and Samsung.

Crypto remains very much the main driver for graphics card prices and availability, though, as mining operations are buying up cards in bulk. 'Bitcoin' is the first word on everyone's lips of course, but these days it's not particularly well-suited to GPU-based mining, whereas alternative crypto-currencies such as Ethereum and Zcash are.

Now, I'll be the first to admit that I've haven't gone far down the rabbit hole of specific currencies. There are many more kinds, and which ones are considered 'best' for mining can change regularly, but, as I understand it, it's currently considered the case that Nvidia cards are better for Zcash and AMD cards for Ethereum, both of which could be traded for cash or Bitcoin, or kept around in the hope they'll accumulate.

There are a whole lot of people going into this stuff hard, which means buying multiple GPUs and setting them to mine all day, every day. The larger-scale miners buy cards in bulk which is why most places are out of stock, and it's this lack of availability that drives up prices. Certain cards are considered sweet spots due a combination of tech and power draw, and the GTX 1070's a prime example of that - my Nano, meanwhile, is favoured because it's also very small and thus you can get more of 'em into one space.

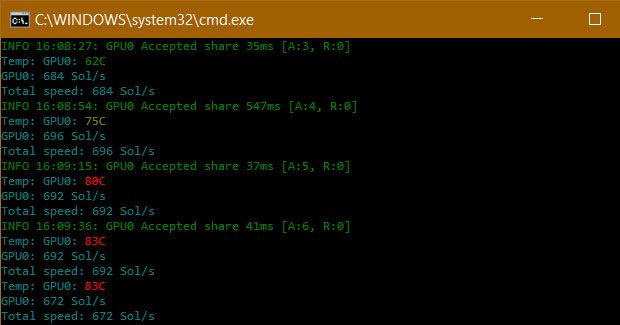

I can't speak to the specific maths of other boards, but the example I can give you - after setting my PC up to mine Zcash a few days back, purely to research this piece - is that of the GTX 1080 Ti. When mining as part of a pool (solo mining by and large requires a whole building full of PCs to pay off - which is another reason why cards are in short supply and with crazy prices, because this stuff really is happening at an industrial scale), I can expect this card to earn between 0.3 and 0.4 Zcash, or ZEC, in the space of a month.

Running it for just an hour earned 0.0004 ZEC, and before I bailed out because the mining was making my mouse lag too much, I was up to 0.00173 ZEC. I may need to cash that in for ibuprofen to treat the headache caused by the constant fan noise, and moisturiser for my skin, desiccated by the sort of heat no British room should know in early February.

After energy and cooling costs are deducted, right now this would translate to between $110/£80 and $140/£100 per month, if I sold on the Zcash for conventional money. This would pay off the cost of a new GTX 1080 Ti (if bought at RRP) in somewhere between six and seven months, and if I ran it for a year I'd be looking at £600-700 profit, as well as having a top-flight gaming card.

This is presuming Zcash and other cryptocurrencies hold their value for that long, of course, which can be affected by everything from investor confidence to new regulations, to the mining market becoming oversaturated by all these people buying all these graphics cards, and most of all to whether or not hardware makers step up production to meet demands. This isn't straightforward, because they don't want to be left with hard-to-sell excess if the market nosedives even more dramatically than it has in recent weeks, and because the DDR shortage limits production in the first place.

The unpredictiably of the crpyto market means it's also possible rates could spike once again, and thus miner profits grow significantly too. But clearly it's a big gamble. The more comparatively cost- and power-efficient mid-range cards are thus a more appealing prospect for the speculative miner.

Personally, I am deeply disinclined to leave my GPU mining - not just because of the deep uncertainty around these currencies, but also because of environmental impact, noise and heat generation and potentially shortening my card's lifespan. People rushing wholesale into this stuff don't care about any of that, of course, and folk running multiple PCs with multiple cards could potentially get themselves into a situation whereby they can pay off replacement boards fairly quickly. However, those tempted by setting their PCs to mine should be conscious that they're up against people with literal warehouses full of dedicated mining PCs, and in the longer term that's only going to worsen the odds of your GPU digging up the right numbers.

Where does this end? God, no-one knows, but in the short term, we've got a real problem - upgrading our PCs for new games is pretty much impossible right now, or at least deeply unwise. It almost gets into a situation where you have to mine in order to pay off the price-gouge, which is absurd and horrible.

On the other hand, you might have some cash in the attic if you've an old card or two sat around. Another example I can give is that of my even older GTX 970, which I'd have been lucky to get £70 for a few months ago, but sold on for £160. Which I regret - I settled for the first offer because I was convinced all this would be over any day now, whereas if I'd hung on for another week or two I'd probably have bagged £200. So there's a lower-level gamble for you - you could sell your old kit now to fund an upgrade a few months later, when maybe/hopefully prices will have settled down, or you could sit on it in the hope values keep going up, while risking them suddenly crashing.

Nvidia and AMD, for their part, are yet to go far out of their way to addresss. It's good for their share price, after all, plus there's the issue of manufucturing shedloads of GPUs only to suddenly find that no-one wants to buy 'em anymore.

However, Nvidia at least has made some noises that retailers should prioritise game-players over miners, though it's a suggestion rather than a rule, and God knows how it could be enforced. AMD, meanwhile, claimed in a recent investor call (as reported by Polygon) that it does intend to ramp up production, noting that GPUs sold for crypto-mining currently constitutes "a good part of our business." However, they are limited by the reduced availability of GDDR5 and HBM2 memory used by their boards.

A more concrete attempt to tackle this is that some major online retailers are restricting sales of graphics boards to one per customer, although I imagine that anyone running a GPU farm is more than capable of setting up multiple accounts on Scan or Ebuyer. What no-one is doing, obviously, is pricing GPUs in accordance with their original RRPs, which you can cross-check against here and also (if you're in the US) check availability if you're thinking of buying a card.

I would very strongly suggest that you keep your upgrade powder dry for now, and pray that this year's big games don't go too overboard on system requirements. Or as a stopgap solution, you could try out Nvidia's GeForce Now cloud gaming thinger, which works a whole lot better than we suspected it might.